One by one, downtowns have come back to life from the dark days of the pandemic’s onset. But Canadian downtowns? Not so much.

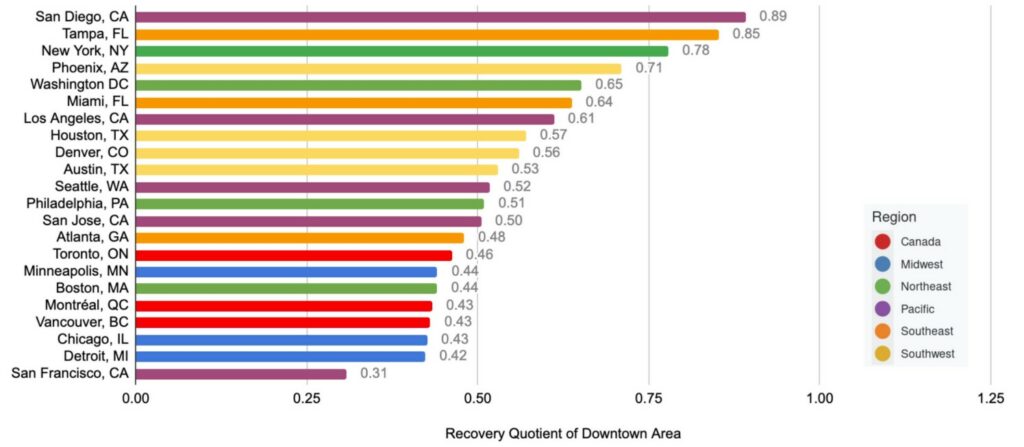

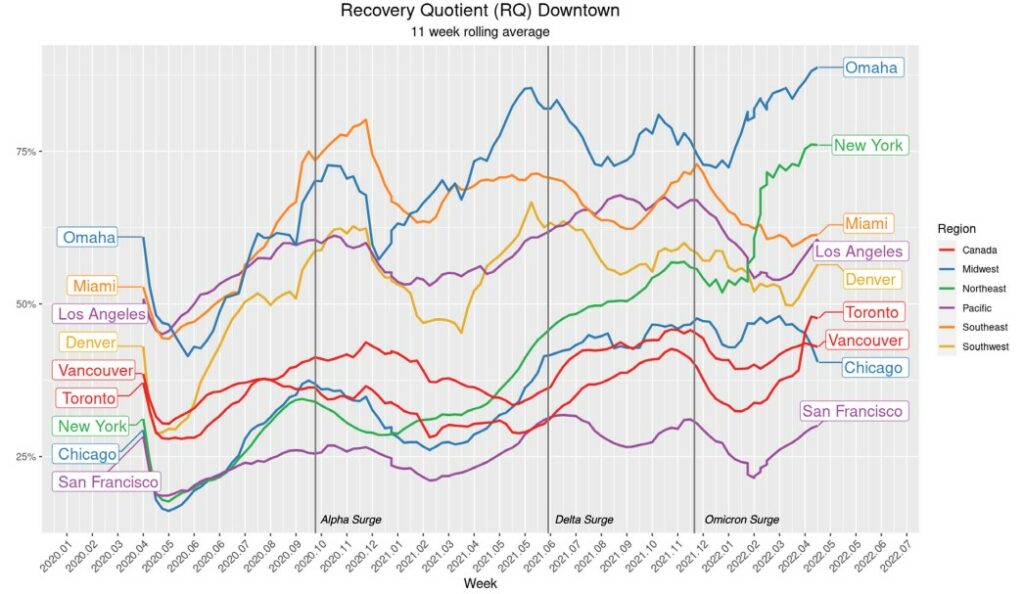

Looking at cell phone activity at points of interest (POI) in the downtowns of the top 62 cities in North America, the median downtown has seen about 56% of its activity come back (Figure 1) (comparing Spring 2022 to Spring 2019, pre-pandemic).[1] Nine Canadian cities perform at or below that median, and just one (Halifax) is above. Their trajectories look promising – for example, Toronto was at just 34% at the end of February, versus 46% at the end of May (Figure 2). But in the same period, New York City went from 61% of pre-pandemic activity to 78%.

Figure 1. Ranking of Downtown Recovery Rates in Large Cities

Figure 2. Downtown Recovery Rate Trajectories in 9 Large North American Cities

So why do some cities lag, while others have come roaring back?

Obviously, the extent and nature of lockdowns play a role, as does the weather, and on both fronts Canada is disadvantaged relative to our neighbours to the south.

But the biggest clues lie within the cities. In order to explain recovery patterns, we joined downtown POI data to 43 explanatory employment and socio-economic variables representing the industry mix of downtown employment and the characteristics of downtown residents. Our study found that the key factors driving recovery rates are the density of population and businesses downtown and reliance on the car for the commute, along with the presence of sectors that are continuing to support remote work (such as tech and professional services).

Comparing the economic, social, and built characteristics of Toronto to New York City suggests why Toronto’s recovery is lagging. One quarter of Toronto’s downtown workforce is in professional, scientific, and technical services – a category that comprises law, accounting, advertising, architecture, and consulting firms, as well as computer systems design – i.e., the types of firms where highly skilled professionals work alone productively, and thus continue to allow remote work. In comparison, just 18% of downtown workers in New York are in this sector. Conversely, only 5% of Toronto’s downtown workforce is in public administration and support, compared to 14% in New York. Both cities are diverse relative to others in North America; it’s just that Toronto is not diverse enough.

Recent surveys suggest that remote work will likely be a permanent feature of these types of metros. Although many employers are beginning to enforce in-person work requirements, tight labour markets for high-skilled workers – as in Toronto –mean the employers have little leverage.

Thus, it is time to reinvent downtown Toronto. Most importantly, Toronto should look to diversify its economy by encouraging different economic sectors to move downtown. Cities should help developers convert older office buildings to residential, institutional, and recreational uses.

Toronto also needs to be proactive about recreating downtowns for people. This could mean creating outdoor spaces with cultural events; rethinking streets for transit, bikes and pedestrians; moving parking to the outskirts of downtown; and attracting diverse segments of the population to visit (both in terms of age and race/ethnicity). Unlike past recoveries, this may take significant public-private collaboration to accomplish, given the extensive intervention required to remake space.

Our research offers a glimpse into downtown recovery at this point in time, but it will be important to continue to track recovery with this data granularity, in order to pinpoint trends. Our future research will also examine factors such as the role of lockdown policies, political leanings, weather, and new downtown development in the recovery.

For more details, visit downtownrecovery.com.